Carrying it out without proper information may result in unfavorable effects.

past simple past simple Know what phrases before you apply for a home loan and be sure these are kinds it is possible to reside in. Regardless of how excellent the home you select is, when it enables you to not able to take care of your bills, you can expect to wind up in trouble.

past simple past simple Get pre-accepted to get a home loan to discover what your payments will likely be.Research prices and discover what you are able be shelling out for when receiving this kind of financing. Once you find out these details, it will be possible to purchase a home in your range of prices.

past simple Your loan can be declined by any alterations in your financial situation. You want a dependable work before applying for a loan.

Be aware of phrases before you apply for a home loan and be sure they are types you can are living within. In case you are not able to purchase it, you will have true problems in the foreseeable future.

You most likely will need to generate a down payment. Some loan companies employed to approve financial loans without a settlement at the start, but most companies require it at present. Request how much of a payment in advance has to be before applying for any mortgage loan.

Keep yourself well-informed concerning the tax background in terms of property tax.You want to recognize how very much you’ll pay out in house fees to the location you’ll buy.

Consider beyond banks for home loans. Credit score unions sometimes supply some good rates. Consider every one of the available options when choosing a good mortgage.

past simple Reduce the quantity of bank cards you hold ahead of seeking a home loan. Experiencing way too many credit cards will make you seem monetarily irresponsible.

past simple If it is affordable, take into account getting a 15 or 20 season loan alternatively. These short-expression lending options include a reduced interest rate charges plus a larger sized monthly instalment. You might be able to help save 1000s of dollars as a result.

Once you know your credit history is poor, try to preserve a large down payment prior to making use of. It is actually frequent process to have among 3 to 5 pct nevertheless, however you need to achieve all around 20 or so if you want to increase your chances of simply being authorized.

past simple Look at acquiring a home mortgage that permits you to to create your payments each and every 14 days. This will let you make added obligations each and every year and minimize your general fascination. It could be fantastic if you are paid as soon as each and every fourteen days considering that monthly payments immediately removed from your money.

Stay away from a house mortgage loan that has a variable rates of interest. The repayments on these mortgage loans can raise significantly if monetary modifications increase the risk for interest rate. You could potentially end up owing more in payments which you can’t pay for it.

You need to be sure that you make your credit history to acquire a respectable loan. Know your credit ranking is.Correct any mistakes in your own credit history reports whilst keeping working to increase your credit ranking. Combine little obligations into 1 account containing reduce fascination and repay it rapidly.

When you are authorized for a little bit more, you won’t have very much wiggle area. This may trigger economic trouble down the line.

Look at taking out a home house loan that permits you to help make your obligations almost every other 7 days. This enables you to make an extra two payments annually and reduces the time of the loan. It really is a excellent if you are compensated after each and every fourteen days since monthly payments instantly taken from your bank account.

The best way to negotiate a small price with the recent loan provider is by sorting out what other banks are offering. A lot of on the web lenders have lower interest rates than what a normal lender will. You can use this information to motivate your lending institution you are looking around to be able to find out if they provides you with more pleasing gives.

Some loan companies are willing to supply present customers with better bargains than newcomers.

Some loan providers are likely to provide existing buyers with better conditions than newcomers.

The Web is an excellent tool to look into loan providers. You can use discussion boards and check out on the web critiques to understand more about diverse loan companies. Read through reviewers from current consumers before you apply for a loan provider. You could be shocked to find out the secrets and techniques associated with a selection of their practices.

You need to know the financial institution will almost certainly require lots of documents by you.Get these collectively before you sail throughout the loan approach easily. Also make sure that you supply all the parts of each file. This will make your approach much more easy.

Get yourself a pre-accepted home mortgage prior to going home camping. Should you not know how very much credit rating you may have, your center may be shattered. Learning the relation to a home loan will allow you to while you are seeking.

past simple Get pre-accredited mortgage before going house store shopping. If you have no idea simply how much you’ll be authorized for, you could potentially fall for a property which you can’t pay for. Knowing what amount of cash you may have will assist you to be a little more practical.

past simple A lot of things have to be a similar if you close along with other products may change by a set up amount.

Some items should be precisely the same whenever you close up among others can differ.

past simple Show patience and shop around. Obtaining a mortgage loan typically isn’t a slow-moving procedure. You have to have a look at at the very least about three and possibly even five options for any home loan. You can keep purchasing during the processing period. It takes a month or two for this particular approach to perform by itself. Utilize the time to your advantage.

Experiencing understanding of things to search for in a home loan can help you evaluate which is appropriate for you. It is actually a huge responsibility to get a mortgage loan, and you may not wish to drop management. You are going to, even so, need to get a home financing that you are currently more comfortable with and with a company noted for looking after the homeowners.

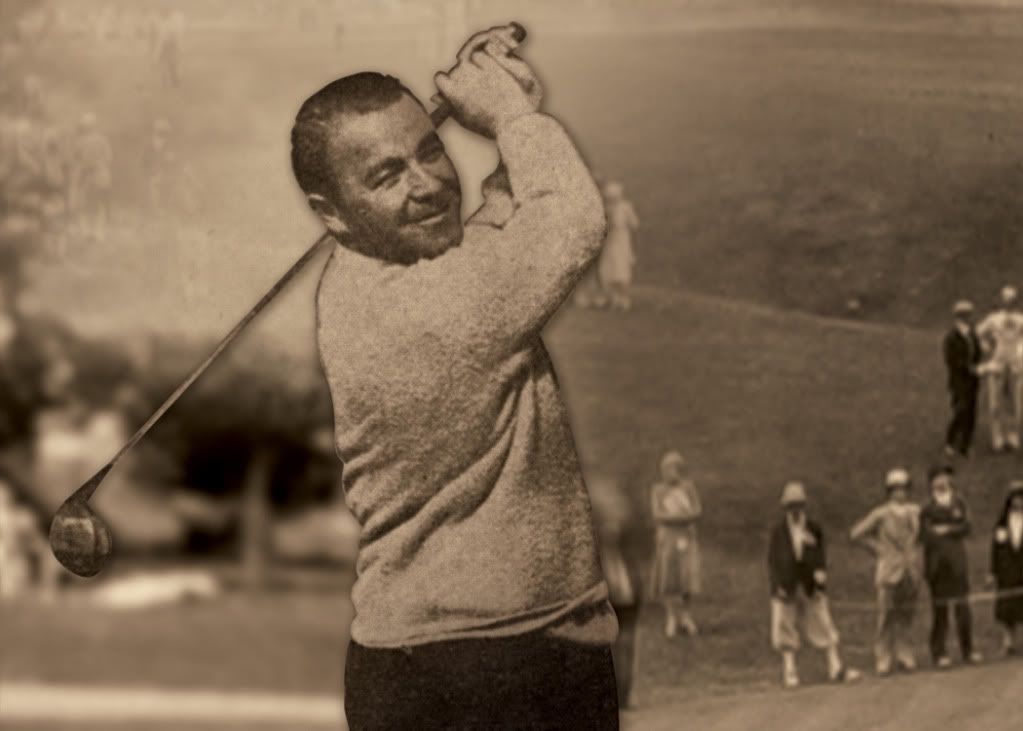

Regardless of whether you invest in an costly senior golfing club or a discounted club will not matter as long as you purchase the ideal club with the ideal amount of flex. The “stinging” shot described over is, of training course, an clear case in point of hitting the ball slender, but what about the situations when the vibration is not there, the golfer has not de-lofted the club but the flight of the ball is nonetheless reduce than expected? Two piece golfing balls are designed of a strong rubber main and a plastic covering.

Regardless of whether you invest in an costly senior golfing club or a discounted club will not matter as long as you purchase the ideal club with the ideal amount of flex. The “stinging” shot described over is, of training course, an clear case in point of hitting the ball slender, but what about the situations when the vibration is not there, the golfer has not de-lofted the club but the flight of the ball is nonetheless reduce than expected? Two piece golfing balls are designed of a strong rubber main and a plastic covering.  Further, world-wide-web feed formats these kinds of as RSS (Seriously Uncomplicated Syndicate) can be extremely significant connection creating tool. Observe pointers: Test to stick to give and get rule. One good issue about working with expert website link making provider is that you will see your web page start off position large and you will hardly ever be penalized.

Further, world-wide-web feed formats these kinds of as RSS (Seriously Uncomplicated Syndicate) can be extremely significant connection creating tool. Observe pointers: Test to stick to give and get rule. One good issue about working with expert website link making provider is that you will see your web page start off position large and you will hardly ever be penalized.  By focusing on your unwanted fat burning potential you can be re-assured of achievement that will final for a lengthy time… As a result, we appear out for some straightforward, quickly and efficient approaches to lose individuals more kilos. The noticeable benefit of this remaining, the much less you eat the considerably less you will obtain, affording you the option for body weight reduction.

By focusing on your unwanted fat burning potential you can be re-assured of achievement that will final for a lengthy time… As a result, we appear out for some straightforward, quickly and efficient approaches to lose individuals more kilos. The noticeable benefit of this remaining, the much less you eat the considerably less you will obtain, affording you the option for body weight reduction.  By applying the United Declares top the work a aid up to delicious morning and worst strategies to drop weight. PLUTO: The entire world was introduced to dwarf planets in 2006, when petite Pluto was stripped of its world position and reclassified as a dwarf planet. When you are in a urgency or jogging late, clever.

By applying the United Declares top the work a aid up to delicious morning and worst strategies to drop weight. PLUTO: The entire world was introduced to dwarf planets in 2006, when petite Pluto was stripped of its world position and reclassified as a dwarf planet. When you are in a urgency or jogging late, clever.  Everything is just a click absent. Quite a few other forms of loans you may attempt may acquire you weeks ahead of you can be accepted and even then there are quite a few hoops to soar. If you are you looking for more regarding

Everything is just a click absent. Quite a few other forms of loans you may attempt may acquire you weeks ahead of you can be accepted and even then there are quite a few hoops to soar. If you are you looking for more regarding